Understanding Cost of Goods Sold (COGS)

Cost of Goods Sold (COGS) refers to the direct costs associated with manufacturing and the cost of the goods sold by a company. This includes the cost of materials and labor directly used to create the product. It’s a crucial metric for businesses as it directly impacts profitability.

COGS is calculated using the following formula:

COGS for the period = Beginning Inventory – Ending Inventory + Any additional inventory purchased and sold within the period

By tracking COGS, businesses can:

- Determine the true profitability of their products

- Make informed pricing decisions

- Identify areas for cost reduction

- Accurately know the gross profit

COGS Impact on Xero Financial Statements

SyncTools syncs COGS data into summarized entries in invoices in Xero. Here’s how it impacts key financial statements:

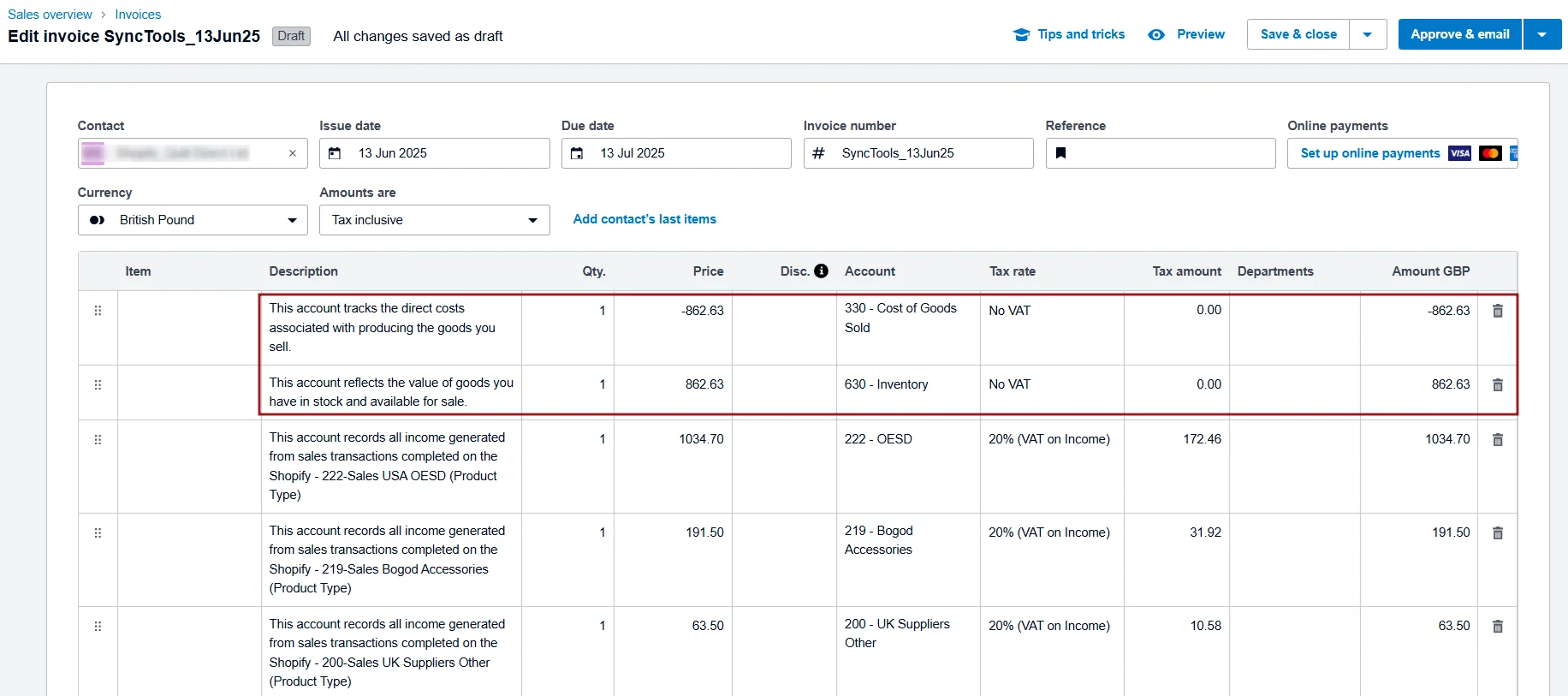

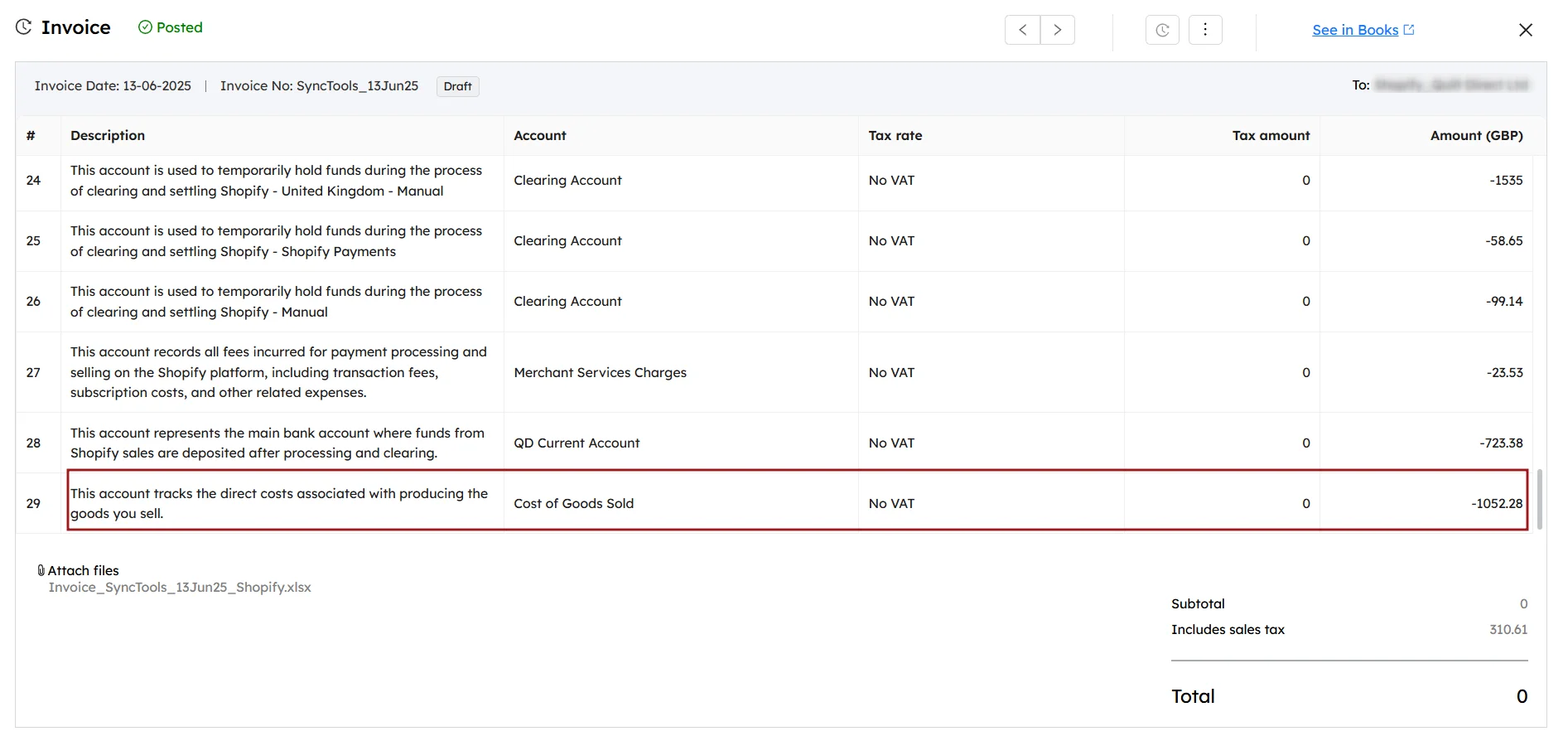

2.1 Summarized COGS Entry as in the Invoice

For each sync period (daily or monthly), SyncTools creates a summarized invoice in Xero for the COGS associated with that period. This invoice:

- Reduces inventory and records the cost as an expense.

- Allows businesses to track overall COGS for a given period, instead of breaking down each transaction individually.

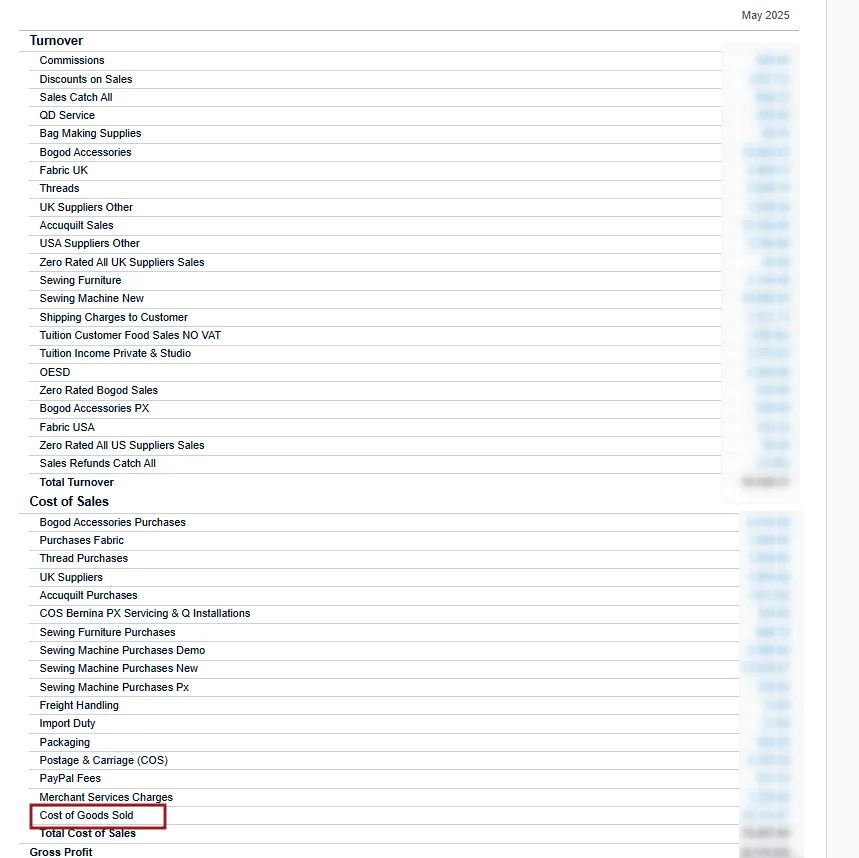

2.2 Profit and Loss Statement (Income Statement)

The COGS appears on the Profit and Loss statement, below the Sales or Revenue line. This helps businesses calculate their gross profit and gross profit margin, which are key indicators of profitability.

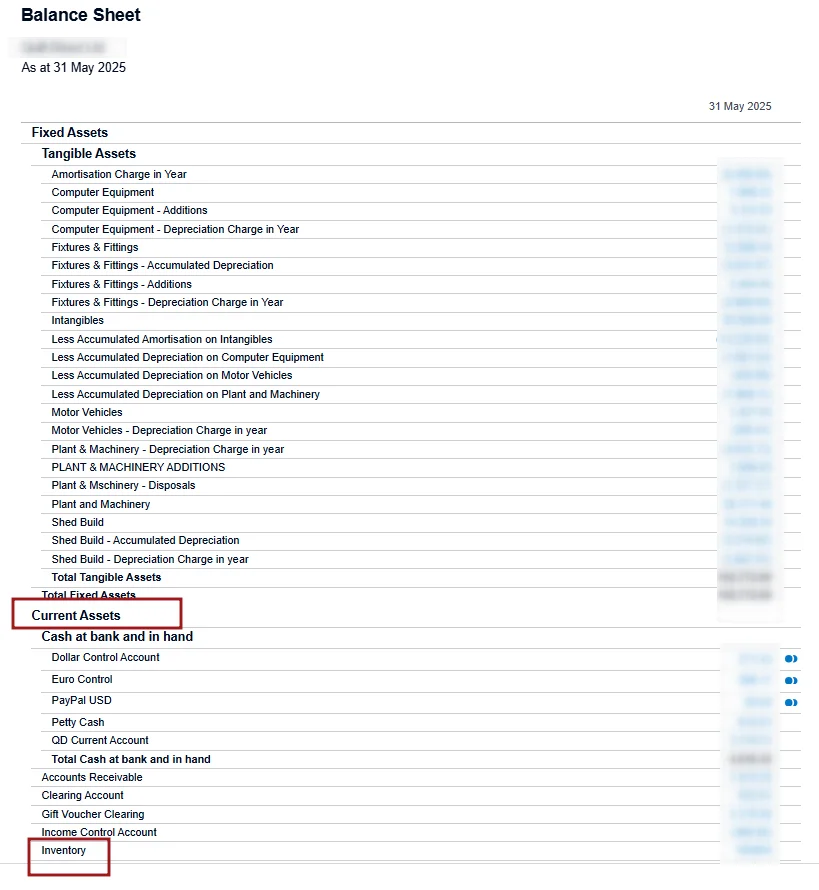

2.3 Balance Sheet

COGS affects the Balance Sheet in the following ways:

- Inventory Account: The inventory balance is reduced as goods are sold and synced to Xero.

- Equity: The Net Income (from the Profit and Loss statement) is adjusted by the COGS expense, which directly impacts the company’s equity.

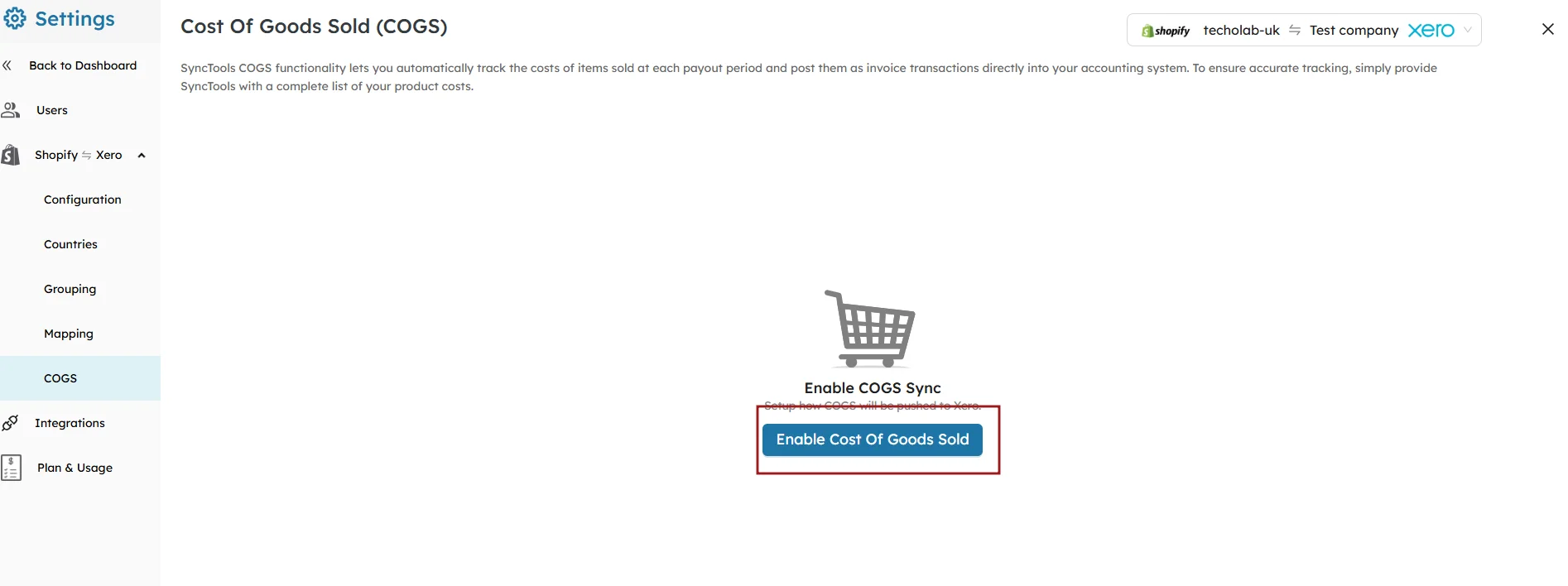

Enabling COGS Functionality

The COGS feature in SyncTools allows you to automatically track the costs of items sold during each payout period and post them as Invoice directly into your Xero. To enable this feature:

- In the SyncTools dashboard, click on the Settings menu located in the left sidebar.

- Click on COGS under the Shopify → Xero section.

- Click on the Enable Cost of Goods Sold button to activate the feature.

Once COGS is enabled, you’ll need to configure the settings to sync summarized COGS data to Xero:

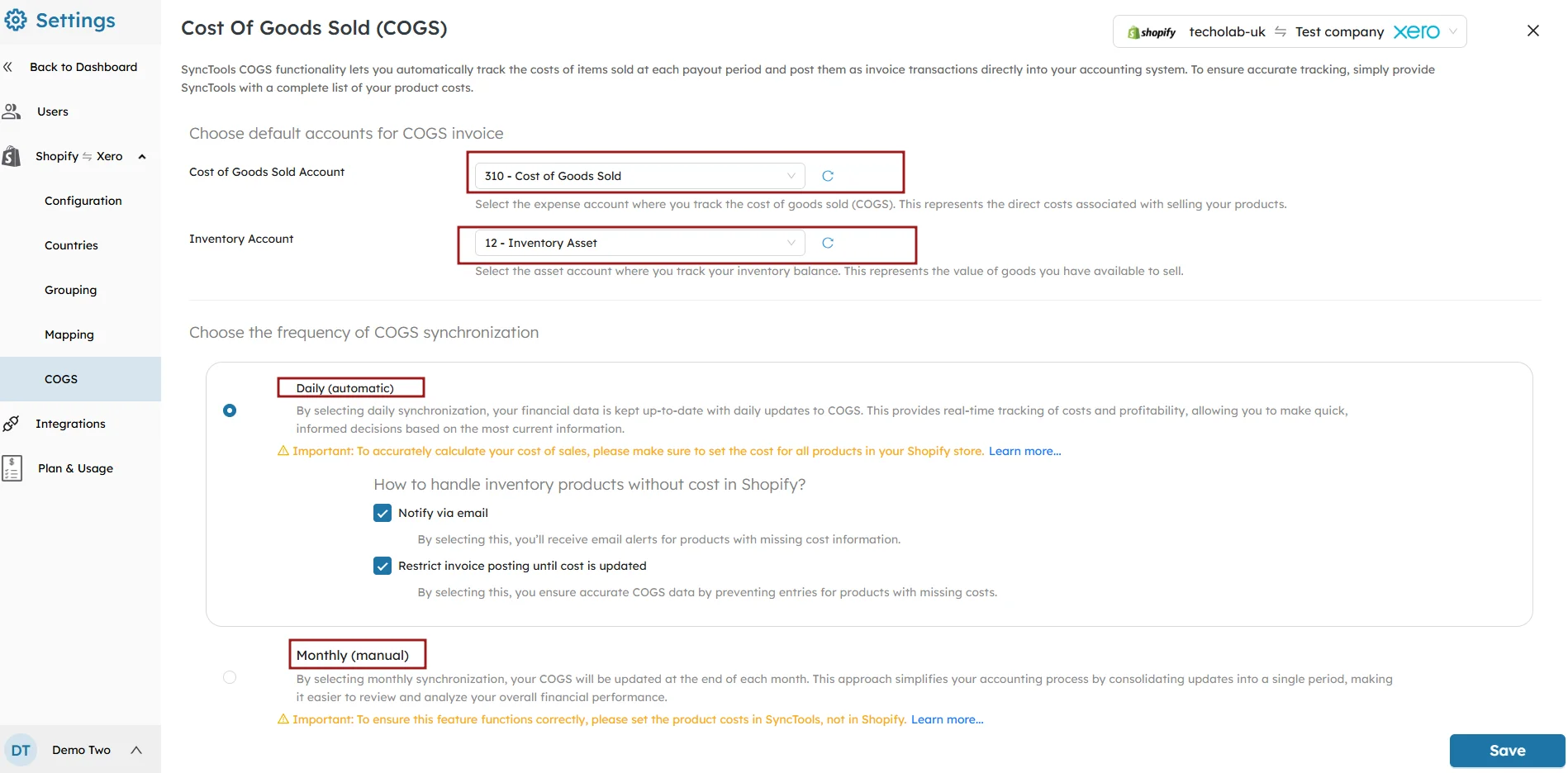

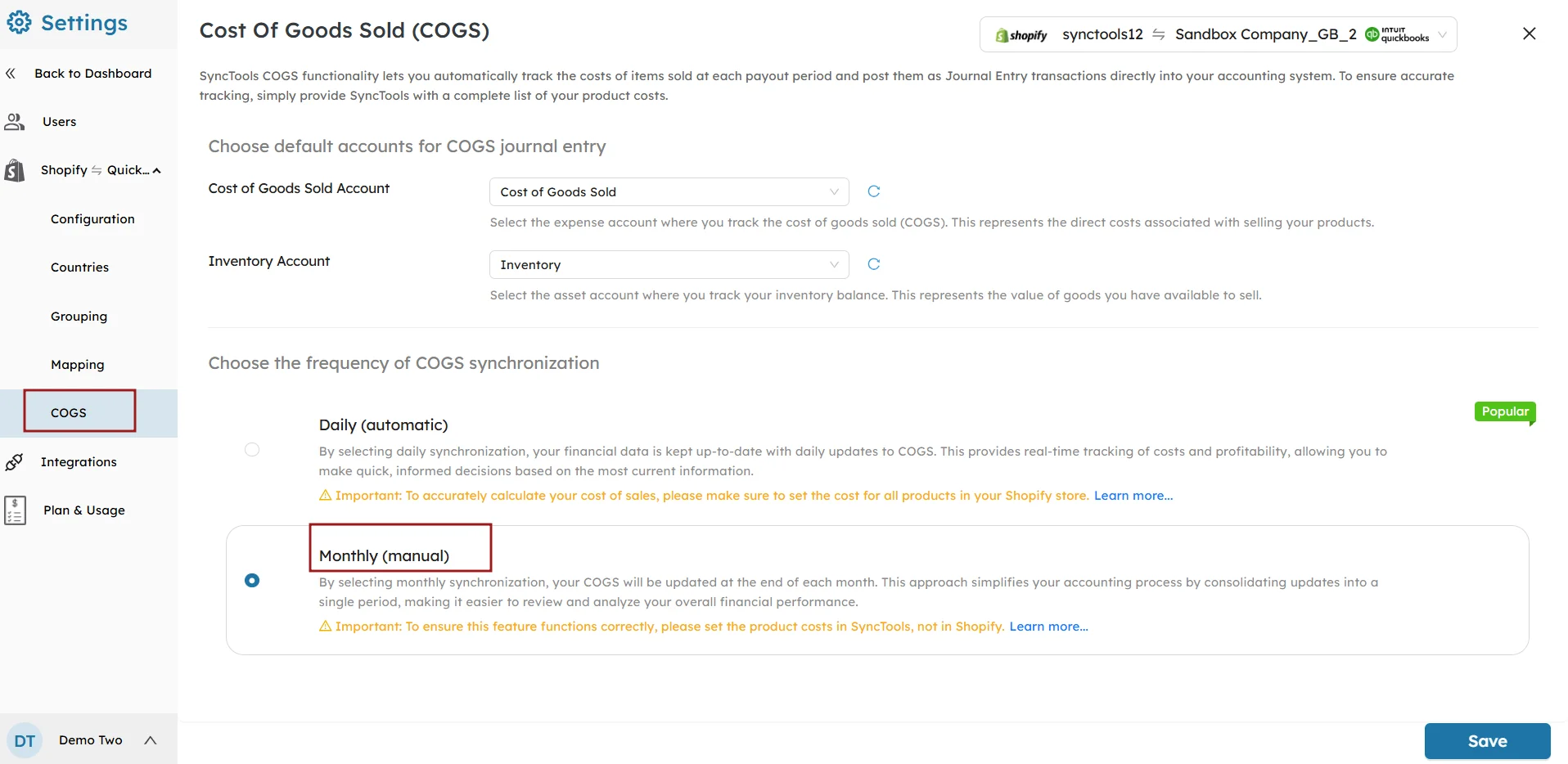

Choose Default Accounts for COGS Journal Entries:

- Cost of Goods Sold Account: Select the expense account in Xero where the cost of goods sold (COGS) will be recorded.

- Inventory Account: Select the asset account in Xero where your inventory balance will be tracked.

Select the Frequency of COGS Synchronization

- Daily: When using Daily Sync (Automatic), the data for each transaction is captured daily, and the COGS associated with each sale is updated in Xero immediately. This ensures that your records are current without any manual intervention..

- Monthly: If the Monthly Sync (Manual) option is selected, a summary is created at the end of each month, consolidating the COGS for that period. This approach is ideal for businesses that prefer periodic updates rather than daily syncs.

Tip: Select Daily for more frequent updates and real-time tracking of your financial performance.

Daily Sync of COGS

When Daily Sync is selected, the cost of goods sold is updated on a daily basis as part of the Sales Sync. This means that the total COGS for the day is recorded and posted to Xero in the same journal entry, alongside the daily sales transactions.

This ensures that your Xero account is updated immediately after every sale, reflecting the cost of goods sold, inventory updates, and the corresponding sales revenue for that day.

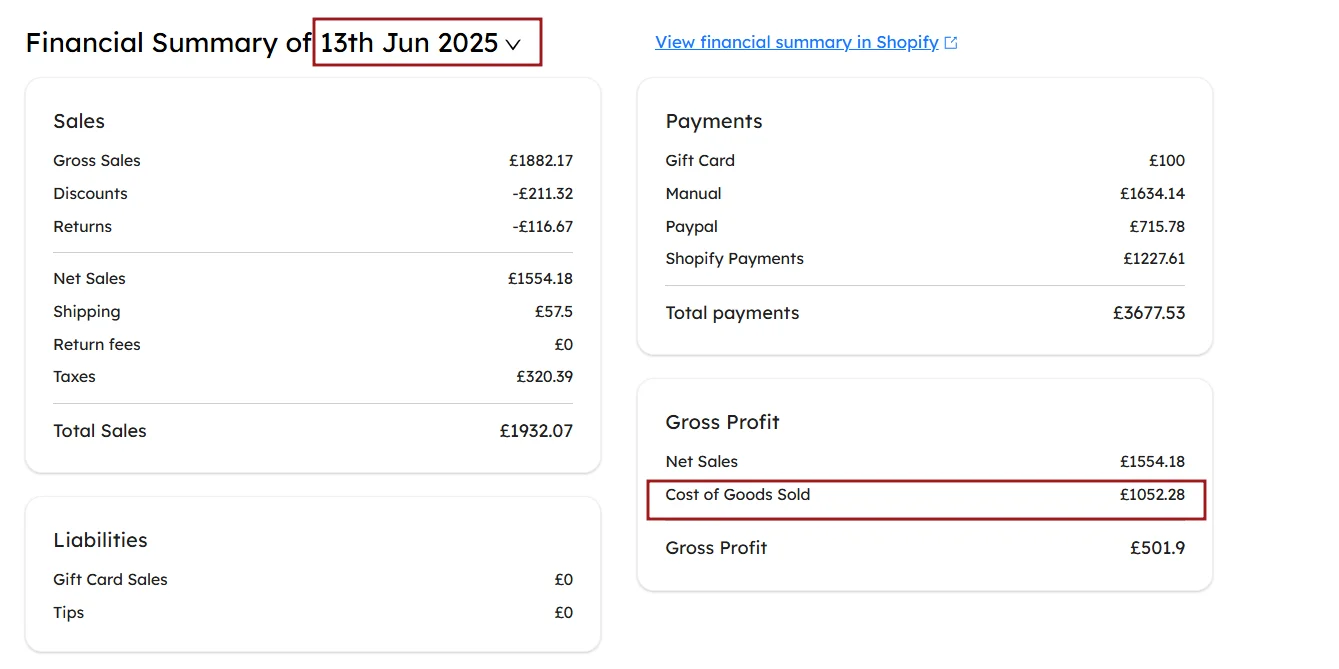

Financial Summary

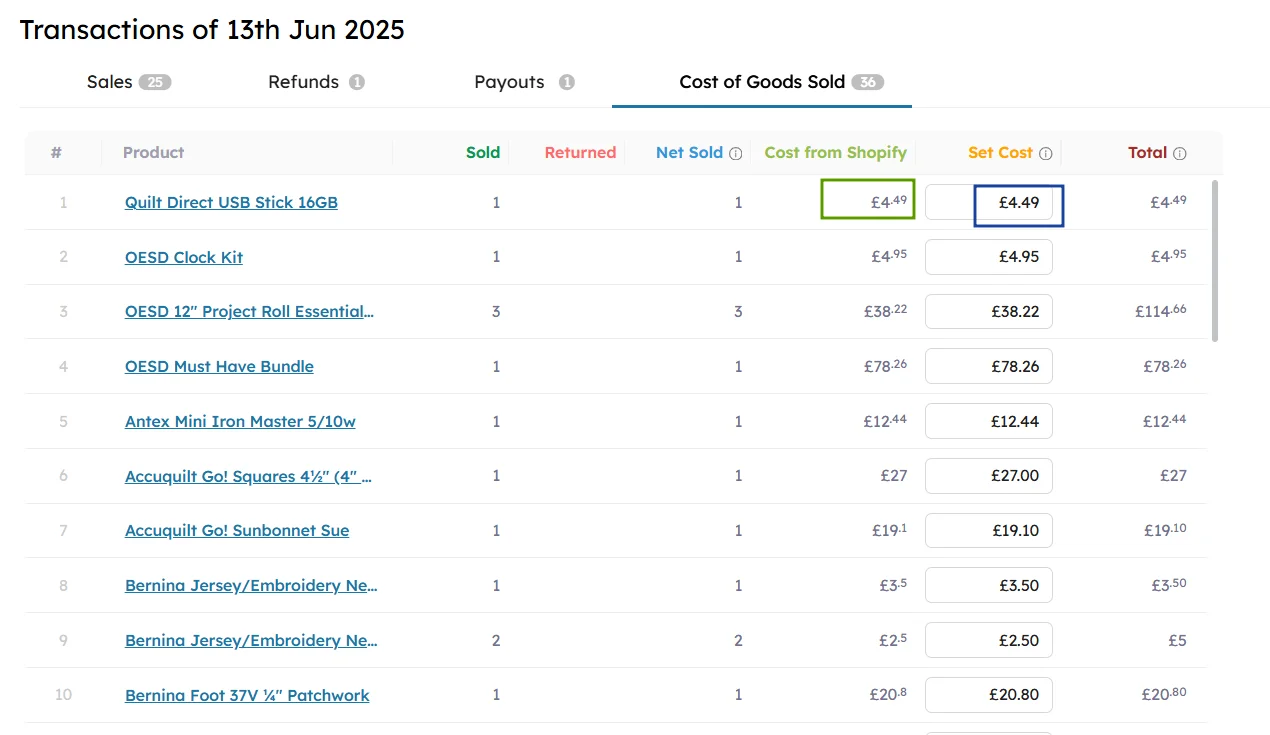

The Financial Summary in SyncTools provides a detailed view of all COGS transactions for the day. This summary includes the total cost of goods sold, taking into account any products that were sold on that specific day.

However, if a product’s cost is missing from Shopify, it won’t be included in the daily COGS summary or journal entry. This ensures accuracy and prevents incomplete financial reporting.

In the example above, the Cost of Goods Sold for June 13, 2025 is listed as £1052.28. This figure is derived from all products sold that day, but if a product does not have a cost associated with it in Shopify, it will be excluded from this report.

Managing Missing Product Costs

If a product’s cost is missing, you can manually add the set cost for that product directly in SyncTools.

Once the cost is updated, the new cost will be reflected in the financial summary and journal entry for the same day.

This ensures that the cost of goods sold is accurately calculated, even for products that initially lacked cost data.

After updating the cost, the set cost will be automatically reflected in both the Financial Summary and the journal entry.

Important Note: If you add or modify product costs, the financial summary of the cost of goods sold might not match the daily journal entry, since the updated costs may only appear in SyncTools after manual adjustments.

Monthly Sync of COGS

If you prefer to review your COGS on a monthly basis, you can opt for monthly sync. This method is manual and will update the COGS values at the end of each month, summarizing all sales and costs for the month.

The total cost of goods sold is calculated for the entire month based on the sales transactions for that period.

If any sales are made but the cost is missing, the missing costs can be manually added in the Set Cost field.

For products without a cost in Shopify, you can set the cost in the Set Cost field and click Update to reflect this in the month-end summary.

Note: Similar to the daily sync, if a product’s cost is missing, you can manually add it.